Insurance

The fusion of the insurance industry with digital technology is accelerating

innovation in the insurance sector. Mainline's Insurtech IDP solutions are essential

for enhancing competitiveness in the future insurance industry.

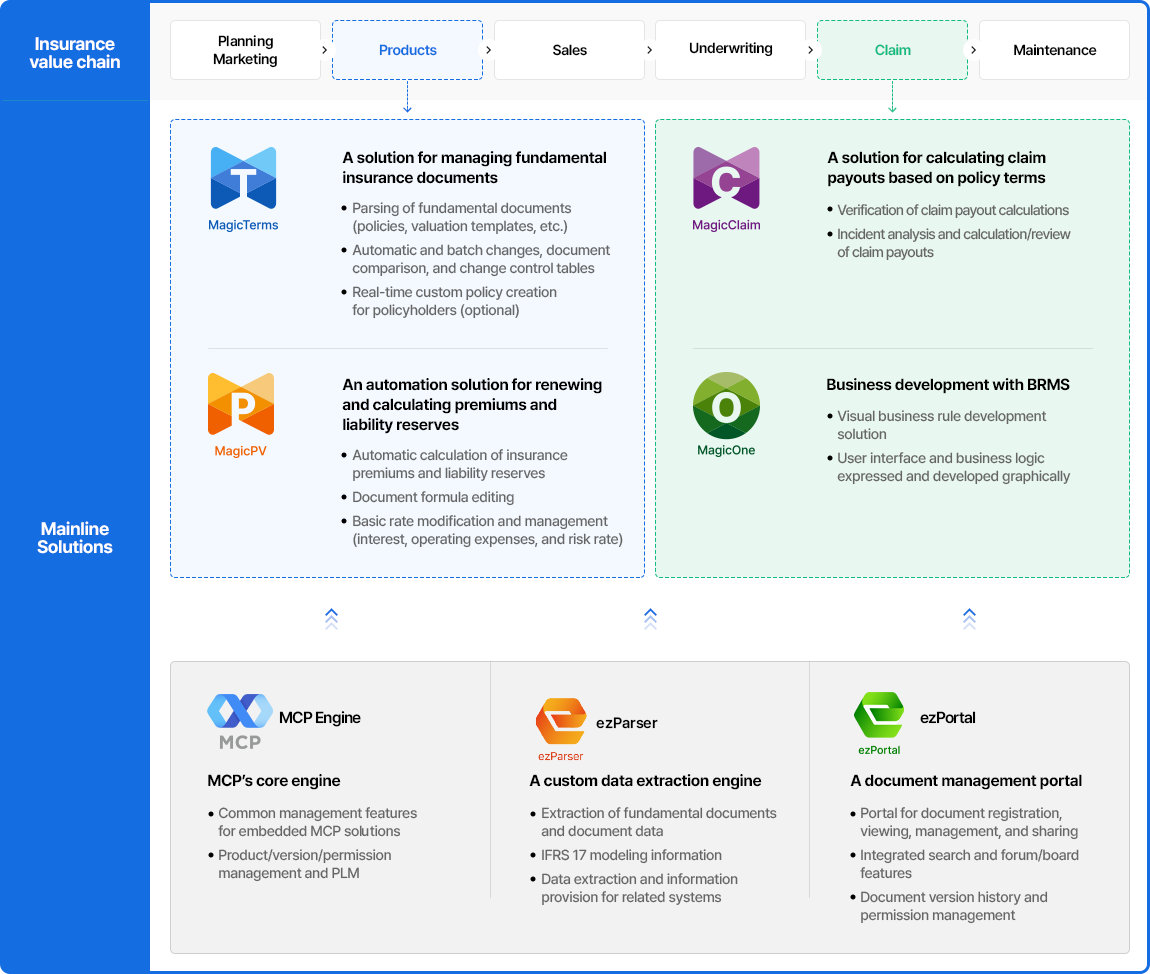

Insurance Value Chain and Magic Solution

Mainline is developing process automation solutions for the entire insurance operation,

from product development and revisions/updates to claims processing for claim payouts.

Key Features

-

-

Operational efficiency

Operational efficiency

- Increased productivity for simple and repetitive document information revisions

and updates through document processing automation

-

-

-

Cost reduction

Cost reduction

- Reduced personnel and management costs for processing documents such as policies

and valuation templates

-

-

-

Data integrity

Data integrity

- Elimination of human error risks, ensuring accurate calculation of claim payouts

and document processing

-

Fields of Applications

Innovation of operational processes in insurance such as product development, underwriting,

claims, actuarial science, and IFRS 17.

-

Automated product development and management

Automated product development and management- Fundamental document management

- Automation and optimization of

document work such as revisions/updates

of fundamental documents (e.g., insurance policies, valuation templates, operational procedure guides), including batch

changes, document comparisons, and

the provision of change control tables

- Custom insurance products

- Mapping main contracts and riders

of customer-specific policies to create

individualized policies for each customer

-

Automated PV renewal and calculation

Automated PV renewal and calculation- PV renewal and calculation

- Automatic extraction of information from

valuation templates for automatic renewal

and calculation of insurance premiums

and liability reserves

- Basic rate modification and management

- Reflecting calculation results by changing or

adding interest rates, operating expenses,

and risk rates of renewed products

(saving changed basic rates in database)

-

Automated claims compensation system

Automated claims compensation system- Claim payout calculation

- Creating and managing payout

condition-specific rules based on policy

coverage and real-time automatic

calculation of claim payouts

- Automated claims processing

- Extracting information by parsing

policy coverage, batch-categorizing and

databasing coverage patterns, and linking

product coverage for automatic

calculation/payment of fixed amounts

and actual losses

Insurance Solution

-

MCP

(Micro Cube Platform)

An intelligent

automation platform

for insurance operations -

MagicTerms

A solution for managing

fundamental insurance

documents -

MagicPV

An automation solution

for renewing and

calculating premiums and

liability reserves -

MagicParser

Customized Data

Extraction Solution -

MagicClaim

A solution for calculating

claim payments based on

policy terms -

ezPortal

A document

management portal

(MCP Version/Web Version)